Nvidia Enterprise, broadly perceived for its developments in designs handling units (GPUs) and computerized reasoning (artificial intelligence), has been a champion entertainer in the innovation area. Financial backers have been definitely watching Nvidia stock because of its unstable development, vital acquisitions, and significant job in arising advances. This article gives a profound jump into Nvidia’s stock, covering its verifiable exhibition, development possibilities, and what financial backers ought to consider in 2024.

Prologue to Nvidia Organization

Nvidia, established in 1993, is a main American worldwide innovation organization. It upset the gaming business with its strong GPUs and has since ventured into areas like computer based intelligence, server farms, and independent vehicles. Nvidia’s imaginative advances have made it a foundation in these quickly developing ventures, drawing in critical financial backer interest.

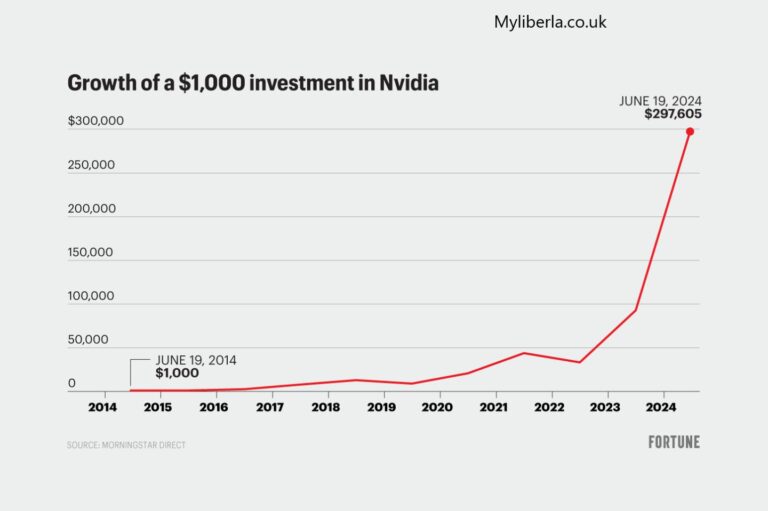

Nvidia Stock Verifiable Execution

Nvidia’s stock has shown striking development over the course of the last 10 years. From being a specialty player in the GPU market, Nvidia has developed into a tech monster with a different item portfolio. The stock has encountered huge appreciation, especially during times of innovative progressions and market development.

Nvidia’s Monetary Presentation

Nvidia’s financials have reliably dazzled financial backers. The organization has detailed hearty income development, driven areas of strength for by for its GPUs and server farm arrangements. The organization’s benefit and solid income are additionally certain pointers for financial backers checking long haul potential out.

Key Drivers Behind Nvidia’s Stock Execution

A few elements add to Nvidia’s stock presentation:

Development in GPUs:Nvidia’s GPUs are the foundation of gaming and expert representation, which keep on seeing powerful interest.

Man-made intelligence and AI: Nvidia is a forerunner in simulated intelligence, with its GPUs being fundamental to AI models and man-made intelligence research.

Server farms:The ascent of distributed computing and man-made intelligence driven server farms has energized interest for Nvidia’s server farm arrangements.

Key Acquisitions:Nvidia’s acquisitions, like Mellanox and ARM (however the last option confronted administrative obstacles), have been pointed toward reinforcing its innovative authority.

Nvidia’s Part in the simulated intelligence Blast

Simulated intelligence has turned into a focal topic in the tech world, and Nvidia is at the core of this transformation. The organization’s GPUs are utilized widely in simulated intelligence preparing and deduction, making Nvidia a basic player in the simulated intelligence biological system. As computer based intelligence applications extend, Nvidia’s stock could see further development.

Nvidia’s Situation in the Gaming Business sector

The gaming business stays one of Nvidia’s center business sectors. The organization’s GeForce series of GPUs is well known among gamers and has set new benchmarks for execution. With the continuous shift towards vivid gaming encounters, Nvidia’s predominance in this area looks good for its stock.

Effect of the Metaverse on Nvidia’s Stock

The idea of the Metaverse, a virtual common space, has built up some decent forward movement, and Nvidia is strategically situated to profit from this pattern. The organization’s GPUs are fundamental for establishing the vivid 3D conditions that the Metaverse guarantees, possibly supporting Nvidia stock further.

Nvidia’s Venture into Independent Vehicles

Nvidia’s introduction to independent vehicles through its DRIVE stage has opened up new roads for development. As the independent vehicle market develops, Nvidia’s stock could acquire from the rising reception of its innovation via automakers.

Key Acquisitions and Organizations

Nvidia’s essential acquisitions, including Mellanox Advances and arranged securing of ARM, in spite of the fact that confronting administrative difficulties, feature the organization’s goal to rule the tech scene. These moves could altogether influence Nvidia’s stock, contingent upon how they unfurl.

Nvidia’s Profit Strategy

While Nvidia is principally viewed as a development stock, it offers profits, but unobtrusive. The organization’s profit strategy mirrors areas of strength for its stream age and obligation to returning worth to investors. For money centered financial backers, this is an extra viewpoint to consider.

Chances Related with Nvidia Stock

Putting resources into Nvidia stock isn’t without gambles. Key dangers include:

Administrative Obstacles:The ARM procurement confronted huge administrative difficulties, which could influence Nvidia’s essential development.

Rivalry:Nvidia faces extraordinary contest from organizations like AMD and Intel, which could influence its portion of the overall industry.

Market Unpredictability: As a tech stock, Nvidia is liable to showcase instability, especially because of movements in tech area feeling.

Nvidia Stock in 2024: What’s in store

Looking forward to 2024, Nvidia is strategically situated to gain by a few development patterns, including man-made intelligence, gaming, and independent vehicles. Be that as it may, financial backers ought to watch out for administrative turns of events, serious elements, and the more extensive monetary climate.

Investigator Evaluations and Value Targets

Numerous investigators stay bullish on Nvidia, refering to its solid market position and development potential. Cost focuses for Nvidia stock in 2024 shift, for certain examiners anticipating significant potential gain in view of the organization’s development pipeline and extending market open doors.

Is Nvidia Stock an Up front investment 2024?

Whether Nvidia stock is an up front investment 2024 relies upon individual financial backer objectives. For those looking for openness to high-development tech areas like simulated intelligence and gaming, Nvidia stays a convincing choice. In any case, financial backers ought to think about possible dangers and assess how Nvidia squeezes into their general speculation system.

End

Nvidia’s stock has been a top entertainer in the tech area, and its future possibilities look encouraging. With its authority in GPUs, man-made intelligence, and arising advances like independent vehicles, Nvidia is strategically set up to proceed with its development direction. Financial backers ought to remain informed about market improvements and consider both the open doors and dangers related with Nvidia stock in 2024.